Flat tax

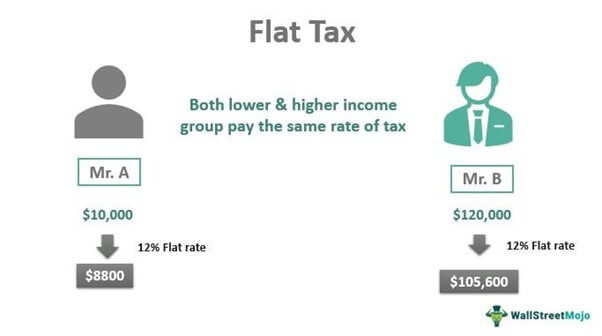

In 1996 Forbes supported a flat tax of 17 on all personal and corporate earned income unearned income such as capital gains pensions inheritance and savings would be exempt. The flat tax concept is straightforward.

If Flat Is Fair Raise The Iowa Income Tax The Gazette

There are various tax systems.

. However Forbes supported keeping the first 33000 of income exempt. That does not mean that taxpayers in Pennsylvania have lower tax bills however. This also applies to some motorhomes.

The flat tax system would also eliminate the estate tax Obamacare taxes as well as the Alternative Minimum Tax. Ohne Grundfreibetrag gibt es damit keine SteuerprogressionEine Einheitssteuer mit einem Grundfreibetrag führt rechnerisch zu einer indirekten Progression. Any income above the deductions would.

Pennsylvania utilizes a flat tax system. A tax levied at the state level against businesses and partnerships chartered within that state. Some things dont have GST included these are called GST-free sales.

This means that every taxpayer in the state regardless of their level of income pays the same percentage of their taxable income in state income taxes. Niente ipotesi immaginifiche al di là delle promesse. If enacted this will be the third time Idaho policymakers reduced individual and corporate income tax rates since.

Youll pay a rate based on a vehicles CO2 emissions the first time its registered. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. In scienza delle finanze la flat tax lett.

Dalla flat tax alle pensioni. The current tax code would get junked. Bonomi intervenendo allassemblea di Varese.

Ma perderebbero ogni deduzione e. Non possiamo permetterci flat tax e prepensionamenti. Forbess flat-tax plan has changed slightly.

Businesses would only be required to pay a one-time 10 repatriation tax on past income. The 25 percent flat tax was. The tax proposal would also reduce corporate taxes to 16 while profits earned abroad would be tax-free.

Confindustria al governo che verrà. First tax payment when you register the vehicle. Flat tax abbattimento del costo del lavoro più sostegno alle imprese e alle famiglie e abolizione del reddito di cittadinanza.

La flat tax che tanto piatta non è La flat tax è da sempre un cavallo di battaglia della Lega che premerà perché sia inserita in manovra per dare un segnale agli elettori delusi dal Carroccio. Typically a flat tax applies the same tax rate to all taxpayers with no deductions or. In some states companies with operations in that state may also be liable for the.

Flat tax supporters often cite the nation of Estonia as proof of the systems benefits. With enactment of the flat tax in 94 days on January 1 Arizona will have the lowest flat tax in the nation. Confrondo le attuali aliquote Irpef con la Flat tax al 15 per professionisti e imprenditori individuali sarebbe un vantaggio rispetto al regime ordinario.

However your tax residency status will be reviewed at the point of tax clearance when you cease your employment based on the tax residency rules. Quindi laltro messaggio alla leader di Fratelli dItalia con lauspicio da parte di Bonomi di una formazione del Governo nei tempi più rapidi possibile ma soprattutto di un esecutivo con ministri autorevoli competenti e inappuntabili. With the new code there would be generous exemptions for adults and children.

Attend our GST webinar to help you to. In 2000 Forbes maintained the same plan. Accessible Brings Learning to Life Comprehensive Making real-world connections to classroom instruction is an important goal of educators.

In the United States the historical favorite is the progressive tax. The IRS partnered with education professionals to bring you the Understanding Taxes Teacher Site an interactive tax education program for middle school high school and. That rate is 307.

Tax residents may use this tax calculator XLS 96KB to estimate the tax payable. 3ottobre con amico Presidente Univa_Stampa RobertoGrassiVA assembleagenerale varese2050Le imprese hanno a. Progressive tax benefits versus flat tax benefits are an ongoing debate with both systems having proponents and critics.

A flat tax short for flat-rate tax is a tax with a single rate on the taxable amount after accounting for any deductions or exemptions from the tax base. Governor Ducey signed the historic tax package into law last year further reducing and streamlining taxes for Arizonans while protecting small businesses from the threat of a 77 percent tax increase. Obiettivi ambiziosi che hanno fatto storcere il naso a diversi economisti a causa dell.

Mi chiamo Irene Licastro ho 20. Idaho Governor Brad Little R has called a special session for September 1 2022 to consider another round of tax reform and relief legislation that would return surplus revenue to taxpayers while making the states tax code more economically competitive. You have to pay.

Mit Flat Tax kurz für Flat-Rate Tax oder Einheitssteuer wird ein einstufiger Einkommensteuertarif bezeichnet. Flat tax is a system that applies the same tax rate to every taxpayer regardless of income bracket. For starters unlike many other states that.

It is not necessarily a fully proportional tax. Gli aut-aut di Confindustria su flat tax e prepensionamenti. Implementations are often progressive due to exemptions or regressive in case of a maximum taxable amount.

Pinned between Russia and the Baltic Sea Estonia is a tiny country with under two million residents. E secondo quanto promesso da Silvio Berlusconi leader di Forza Italia linnalzamento a 1000 euro delle pensioni. Impossibile mantenere le promesse elettorali.

If your stay in Singapore is less than 183 days you will be regarded as a non-resident. Der Grenzsteuersatz ist konstant wodurch Eingangs- und Spitzensteuersatz identisch sind. Understanding Taxes makes teaching taxes as easy as A B C.

Riceviamo e pubblichiamo una lettera-appello da Irene studentessa romana di 20 anni che sta scrivendo la sua tesi a Hong Kong grazie ad alcune borse di studio. Tassa piatta calcolata come percentuale costante è un sistema fiscale non progressivo basato su unaliquota fissa al netto di eventuali deduzioni fiscali o detrazioniSolitamente tale sistema si riferisce alle imposte sul reddito familiare e talvolta sui profitti delle imprese tassate con unaliquota fissa. Il presidente di Confindustria Carlo Bonomi manda un monito chiaro al futuro governo di centrodestra.

Non possiamo permetterci né gli uni né gli altri o altre fantasiose follie e dobbiamo invece impedire lincontrollata crescita di deficit e pil avverte Carlo Bonomi numero 1 degli industrialiLe manovre interne sulla squadra di governo con laut-aut questa volta di Meloni allipotesi Licia Ronzulli ministro della.

Flat Tax Lessons From Slovakia Tax Foundation

Republicans Love The Idea Of A Flat Tax But Does It Actually Work Thestreet

Is The Flat Tax The Biggest Problem Of Bulgaria S Economy 4liberty Eu

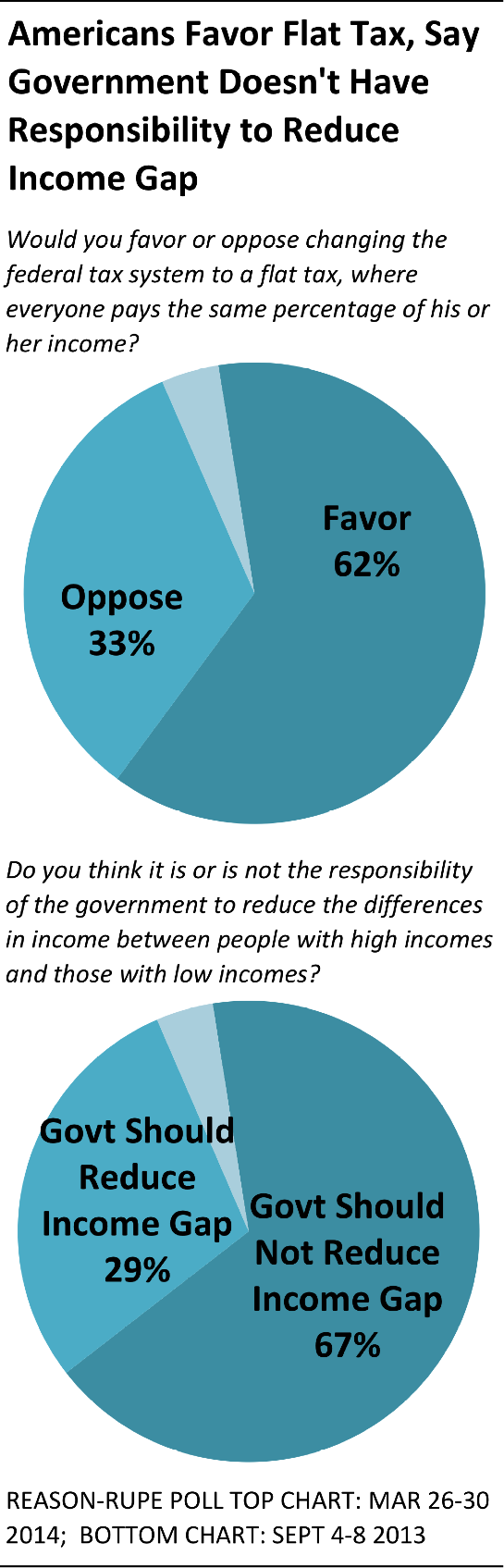

62 Percent Of Americans Say They Favor A Flat Tax

Illinois Used To Have One Competitive Advantage Over Its Neighbors Its Flat Tax Now That S Largely Gone Madison St Clair Record

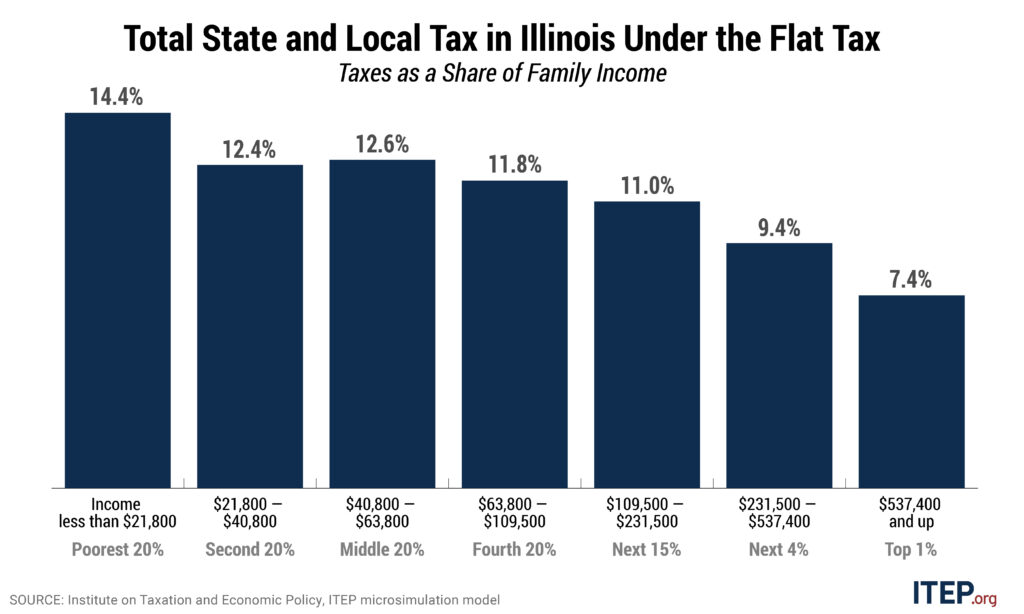

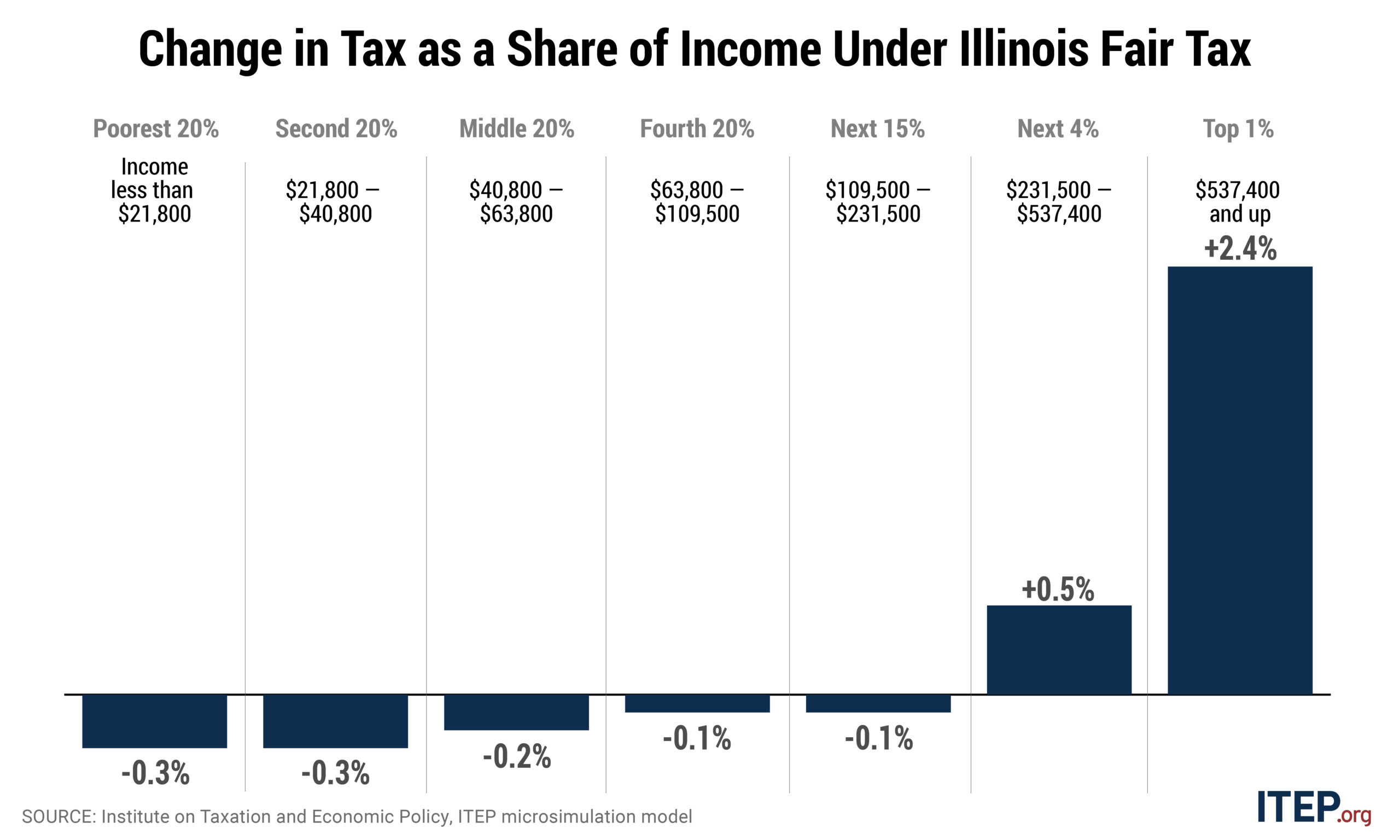

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

The New Italian Flat Tax For High Net Worth Foreigners D Andrea Partners Legal Counsel

Who Would A Move To A Flat Tax Benefit The Best Off Wisconsin Budget Project

Eliminate Poverty With Universal Basic Income And Flat Income Tax Bift

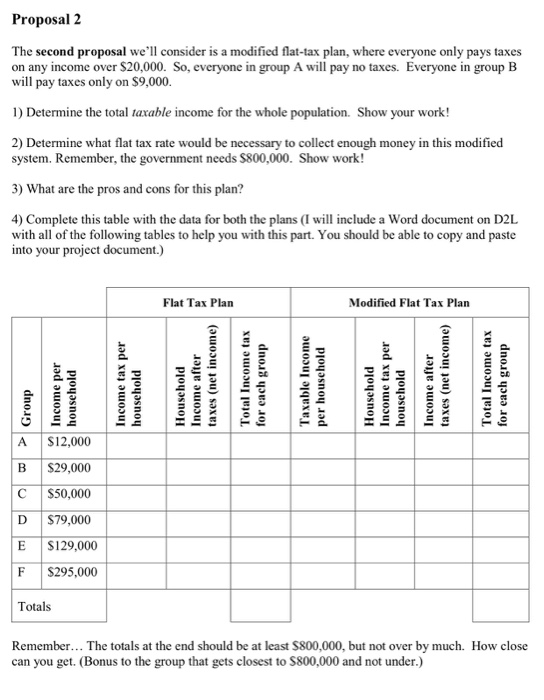

Solved Project 1 Flat Tax Modified Flat Tax And Chegg Com

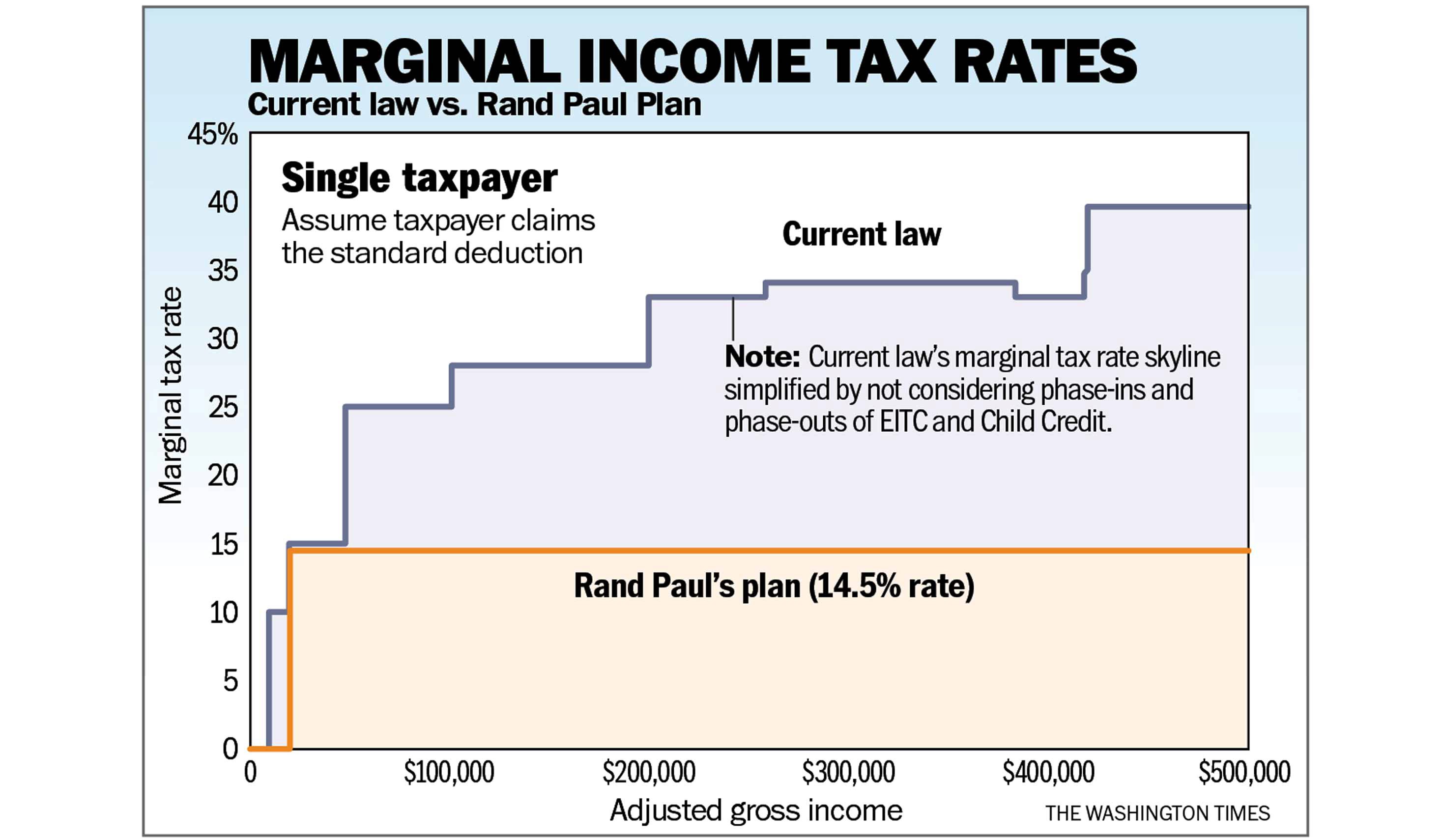

Stephen Moore Rand Paul S Fair And Flat Cuts Taxes For All Washington Times

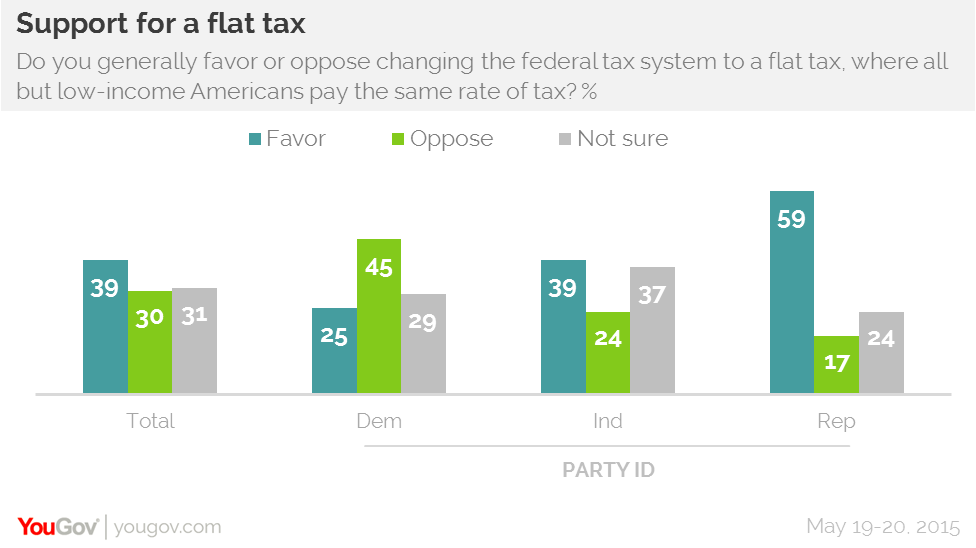

Most Republicans Back A Flat Tax Yougov

An Axiomatic Case For The Flat Tax Thinkmarkets

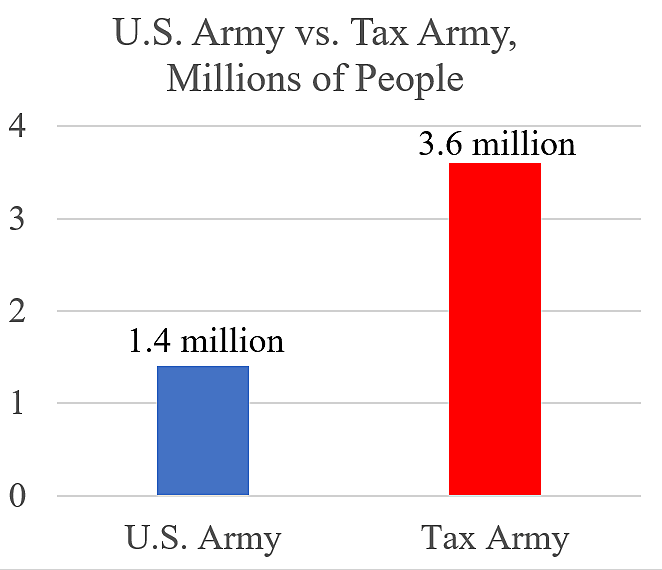

U S Tax Army To Expand Cato At Liberty Blog

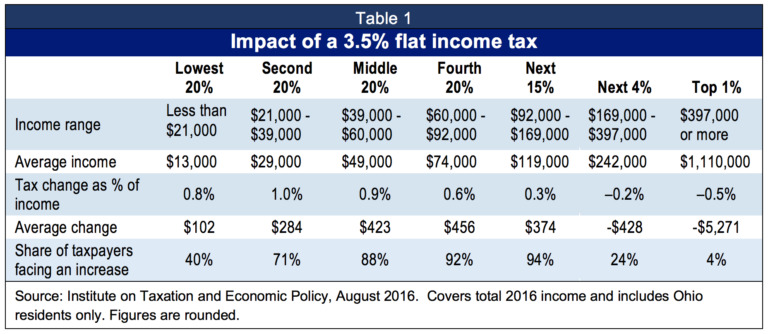

Flat Tax Would Mean More Taxes For Most

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep